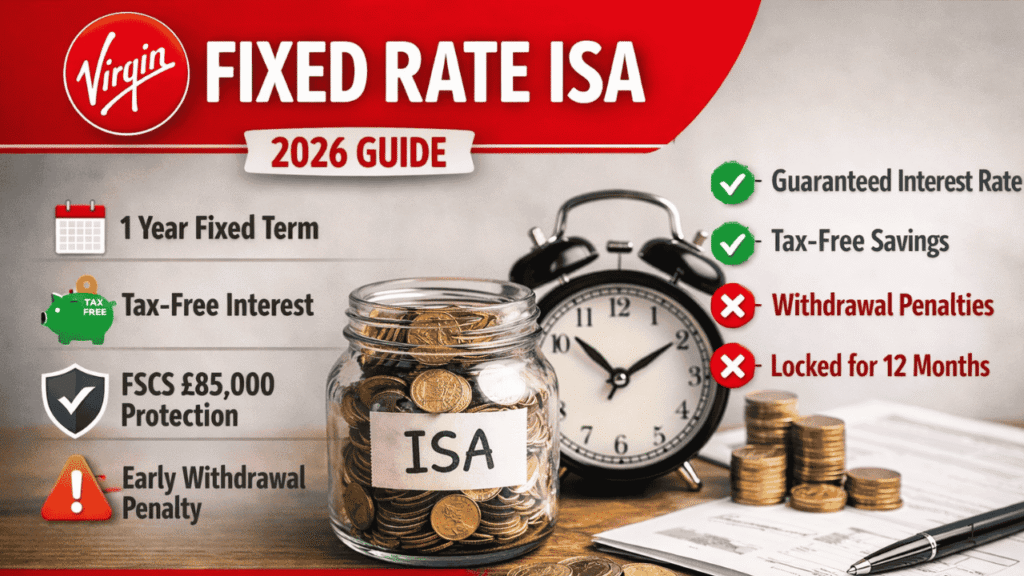

Secure, tax-efficient way to grow your savings, the Virgin Fixed Rate ISA could be a strong contender. With competitive fixed interest rates and the tax-free benefits of an Individual Savings Account (ISA), it appeals to savers who want certainty and stability. In this comprehensive guide, we’ll break down everything you need to know about the Virgin Fixed Rate ISA — including how it works, key features, interest rates, penalties, advantages, disadvantages, and whether it’s the right choice for your financial goals.

What Is a Virgin Fixed Rate ISA?

A Virgin Fixed Rate ISA is a type of Cash ISA offered by Virgin Money in the UK. It allows you to:

- Earn a fixed interest rate for a set period (usually 1 year)

- Benefit from tax-free interest

- Protect your money under the Financial Services Compensation Scheme (FSCS)

Unlike easy-access ISAs, a fixed-rate ISA locks your money away for a specified term. In return, you receive a guaranteed interest rate that won’t change during that period — even if market rates fluctuate.

How Does a Virgin Fixed Rate ISA Work?

The structure of a Virgin Fixed Rate ISA is straightforward:

- You open the account.

- You deposit funds within a specific funding window (usually 30 days).

- Your interest rate is fixed for the duration of the term.

- You receive your interest tax-free.

- At maturity, you can withdraw, transfer, or reinvest your funds.

Because it’s a Cash ISA, all interest earned is completely free from UK income tax.

Virgin Fixed Rate ISA Interest Rates

Interest rates change regularly depending on market conditions and the specific product “issue” available at the time.

Typically, Virgin offers:

- 1-Year Fixed Rate ISA

- Competitive AER (Annual Equivalent Rate)

- Fixed for 12 months

Rates are usually competitive with other major UK banks, though they may not always be the highest available in the market. It’s important to compare current rates before applying.

AER Explained:

AER (Annual Equivalent Rate) shows how much interest you would earn in a year, taking compounding into account.

Key Features of the Virgin Fixed Rate ISA

Here’s what you can generally expect:

Fixed Interest Rate

Your rate is locked in for the full term. This protects you if interest rates fall, but prevents you from benefiting if rates rise.

Tax-Free Savings

You don’t pay tax on interest earned, making it ideal for higher-rate taxpayers or those exceeding the Personal Savings Allowance.

ISA Allowance

You can invest up to £20,000 per tax year across all ISAs (current UK allowance).

Minimum Deposit

Virgin typically allows relatively low minimum deposits, making it accessible to most savers.

Funding Window

You usually have around 30 days from account opening to deposit your funds.

Early Withdrawal Penalty

You can withdraw money during the fixed term, but a penalty applies — usually equivalent to 60 days’ interest on the amount withdrawn.

ISA Transfers

Virgin typically allows:

- Transfers in from previous ISA providers

- Transfers of previous tax year ISA funds

- Transfers out (subject to conditions)

Virgin Fixed Rate ISA Eligibility

To open a Virgin Fixed Rate ISA, you generally must:

- Be 18 years or older

- Be a UK resident

- Have not exceeded your annual ISA allowance

- Hold only one Cash ISA subscription per tax year (unless flexible ISA rules apply)

Always check Virgin Money’s latest eligibility criteria before applying.=

Pros of the Virgin Fixed Rate ISA

Guaranteed Returns

You know exactly how much interest you’ll earn. This is ideal for savers who prefer stability.

Tax Efficiency

Interest is completely tax-free, which can significantly boost returns for higher earners.

FSCS Protection

Your savings are protected up to £85,000 per person under the Financial Services Compensation Scheme.

Competitive Rates

Virgin often offers competitive rates in the UK fixed-rate ISA market.

Simple and Transparent

The product is easy to understand with no complex investment risks.

Cons of the Virgin Fixed Rate ISA

Limited Access

Your money is locked in for the fixed term. Early access triggers penalties.

Early Withdrawal Charges

Typically, there is around 60 days’ interest loss on the withdrawn amount.

Missed Opportunities if Rates Rise

If interest rates increase after you fix, you won’t benefit until maturity.

Deposit Window Restriction

Failing to fund within the required timeframe could affect your interest rate.

Virgin Fixed Rate ISA vs Easy Access ISA

| Interest Rate | Fixed | Variable |

| Withdrawals | Penalty applies | Usually penalty-free |

| Flexibility | Low | High |

| Rate Stability | High | Low |

| Best For | Long-term savers | Emergency funds |

If you don’t need access to your money for a year and want certainty, the Virgin Fixed Rate ISA may be ideal. If flexibility is more important, an easy-access ISA may be better.

Virgin Fixed Rate ISA vs Regular Savings Account

One key difference is tax treatment.

With a standard savings account:

- Interest may be taxable if you exceed your Personal Savings Allowance.

With a Virgin Fixed Rate ISA:

- All interest is tax-free.

For basic-rate taxpayers with modest savings, the difference may be minimal. For higher-rate taxpayers or large balances, an ISA can provide meaningful tax savings.

Early Withdrawal Rules Explained

One common question about the Virgin Fixed Rate ISA is whether you can access your money before maturity.

Yes, you can — but:

- You’ll lose a set amount of interest (usually 60 days’ worth).

- The penalty applies only to the withdrawn amount.

- You cannot replace withdrawn funds at the same fixed rate once removed.

Example:

If you withdraw £5,000 early, you may lose 60 days of interest on that £5,000.

This makes the account less suitable for emergency savings.

What Happens at Maturity?

When your fixed term ends, Virgin will usually contact you with options:

- Reinvest into a new fixed-rate ISA

- Move to an easy-access ISA

- Withdraw your money

- Transfer to another provider

If you take no action, your funds may automatically transfer into a variable rate ISA.

It’s important to review your options before maturity to ensure you secure the best rate.

Is the Virgin Fixed Rate ISA Safe?

Yes. Virgin Money is a regulated UK bank, and deposits are protected by the FSCS up to £85,000 per person.

This means if Virgin Money were to fail, your savings up to that limit are protected.

For savers prioritising security, this offers peace of mind.

Who Is the Virgin Fixed Rate ISA Best For?

This product may be ideal if you:

- Want guaranteed returns

- Don’t need access to your money for at least 12 months

- Have you used or plan to use your ISA allowance

- Prefer low-risk savings

- Are a higher-rate taxpayer

It may not be suitable if you:

- Need flexible access to funds

- Expect interest rates to rise sharply

- Want potentially higher returns from investing

How to Open a Virgin Fixed Rate ISA

Opening the account is typically straightforward:

- Visit Virgin Money’s website.

- Select the current Fixed Rate ISA product.

- Complete identity verification.

- Fund your account within the deposit window.

- Confirm ISA transfer if moving funds from another provider.

Always read the Key Product Information Document before applying.

Tips Before Opening a Virgin Fixed Rate ISA

- Compare current market rates.

- Ensure you won’t need the funds during the fixed term.

- Confirm the early withdrawal penalty.

- Check the funding deadline.

- Review maturity options in advance.

Planning ahead ensures you avoid unnecessary penalties or missed opportunities.

Frequently Asked Questions (FAQs)

Is the Virgin Fixed Rate ISA tax-free?

Yes. All interest earned within the ISA is tax-free.

Can I withdraw money early?

Yes, but a penalty (usually around 60 days’ interest) applies.

What is the minimum deposit?

Virgin typically allows low minimum deposits, but this varies by issue.

Can I transfer another ISA into Virgin?

Yes, ISA transfers are usually accepted.

Is the interest rate guaranteed?

Yes. The rate is fixed for the full term.

Final Thoughts: Is the Virgin Fixed Rate ISA Worth It?

The Virgin Fixed Rate ISA is a strong option for savers seeking stability, predictable returns, and tax-free interest. While it may not always offer the very highest rate on the market, it provides security, simplicity, and competitive performance.

You May Like: Make1m.com Millionaire Life: How to Build Wealth, Mindset, and a Lifestyle of Financial Freedom