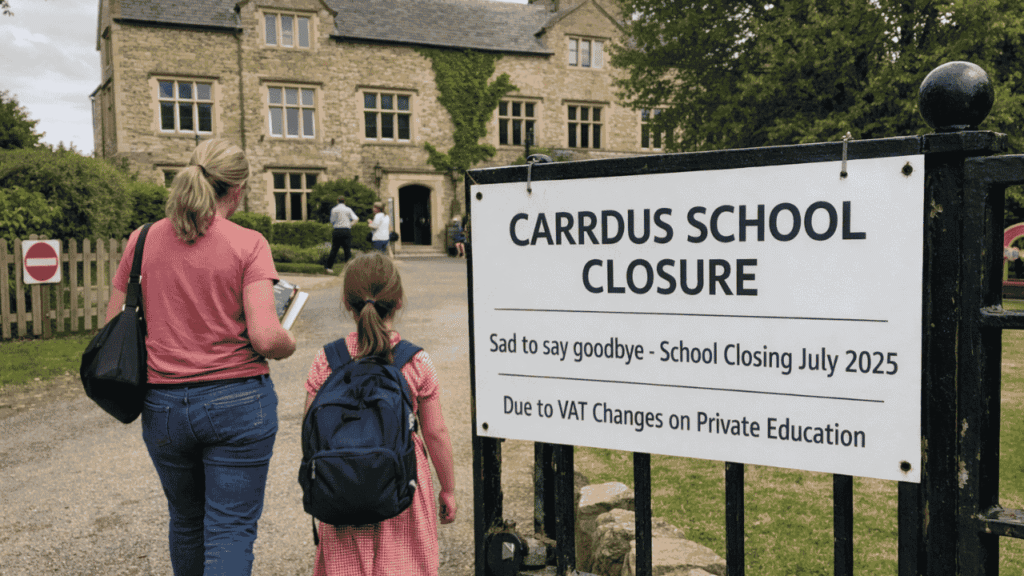

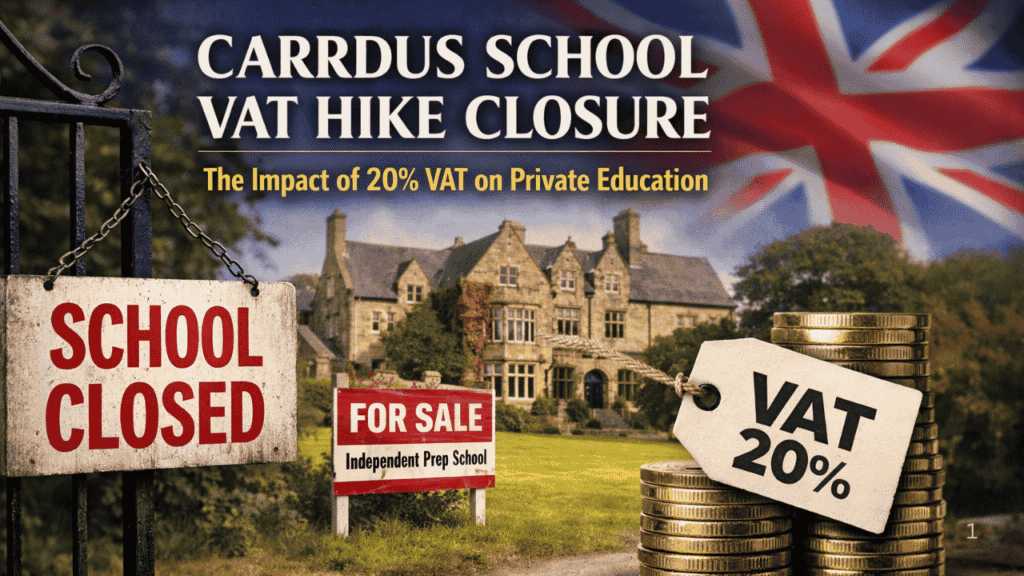

The Carrdus School VAT hike closure has become one of the most cited examples in the UK debate over the impact of VAT on private school fees. Once a well-regarded independent prep school near Banbury, Carrdus School officially closed its doors in July 2025, with school leaders pointing directly to the government’s decision to impose a 20% VAT charge on private education as a decisive factor. The closure has sparked national attention, political controversy, and regulatory scrutiny, raising broader questions about whether smaller independent schools can survive rising costs and policy shifts. This article examines what happened at Carrdus School, how the VAT hike affected its finances, why the closure was contested, and what it means for the future of independent education in the UK.

Background: What Was Carrdus School?

Carrdus School was an independent preparatory school located near Banbury, Oxfordshire, operating from the historic Overthorpe Hall site. For decades, the school educated children primarily in the primary and early secondary years, serving families from Oxfordshire, Northamptonshire, and Warwickshire.

Key characteristics of Carrdus School included:

- Small class sizes

- Traditional prep-school curriculum

- Strong links with local independent senior schools

- Ownership by the Tudor Hall School charity (since 2011)

Like many smaller independent schools, Carrdus relied almost entirely on parental fee income, with limited financial reserves and little ability to absorb sudden cost increases.

The VAT Hike on Private School Fees Explained

What Changed?

In 2024, the UK government announced plans to remove the long-standing VAT exemption for private education, applying the standard 20% VAT rate to independent school fees from 1 January 2025.

This marked a historic shift in tax policy. For decades, private education had been treated as an exempt supply for VAT purposes, meaning schools could neither charge VAT nor reclaim it on many costs.

Under the new policy:

- Parents would pay 20% more on tuition and boarding fees

- Schools would need to restructure billing systems

- Demand sensitivity (families withdrawing children) became a major concern

How VAT Directly Affected Carrdus School

Immediate Financial Pressure

According to statements reported by education sector media, Carrdus School was already operating in a financially delicate position, with pupil numbers below the level required for long-term sustainability.

The VAT hike created several immediate problems:

- Fee increases for parents

Even if the school absorbed part of the VAT, fees still rose substantially. - Parent withdrawals and reduced enrolment

Some families gave notice after the VAT announcement, citing affordability concerns. - Cash-flow instability

Prep schools depend on predictable termly income. A sudden drop in pupil numbers can be catastrophic. - Limited ability to offset VAT

Unlike large private schools with significant assets or endowments, Carrdus had little room to cushion the impact.

In short, the VAT hike did not act in isolation—but it accelerated existing vulnerabilities.

The Decision to Close: Timeline of the Carrdus School VAT Hike Closure

Mid-2024: Policy Announcement

When the VAT policy was confirmed, Carrdus School leadership warned parents that the change would have serious consequences for the school’s viability.

November 2024: Closure Risk Publicly Reported

By late 2024, national and sector press reported that Carrdus School was likely to close, explicitly citing:

- VAT on private school fees

- Rising staffing and operating costs

- Declining pupil numbers

The school indicated that alternatives were being explored, including potential sale or restructuring, but no viable solution had been secured.

December 2024: Closure Confirmed

Governors later confirmed that Carrdus School would cease operations in July 2025, at the end of the academic year.

January 2025: VAT Comes Into Force

The VAT hike formally took effect on 1 January 2025. For Carrdus, this coincided with the final months of operation.

July 2025: Official Closure

Carrdus School officially closed in early July 2025, marking the end of its operation as an independent prep school.

Dispute and Controversy Around the Closure

The Carrdus School VAT hike closure did not occur without challenge.

Parents’ Concerns

Some parents questioned whether VAT was the sole or primary cause of closure. Reported concerns included:

- Claims that alternative buyers or rescue plans were possible

- Allegations that closure decisions were made too quickly

- Questions over governance and transparency

These concerns led to formal complaints.

Charity Commission Involvement

Because Carrdus School was owned by a registered charity (Tudor Hall School), its closure fell under the oversight of charity law.

In early 2025, the Charity Commission opened a compliance case to review whether trustees had acted appropriately in decisions relating to:

- Proposed sale of assets

- Closure planning

- Fulfilment of charitable objectives

It is important to note that a compliance case is not the same as a finding of wrongdoing, but it underscores the seriousness of the dispute.

Was VAT the Only Reason Carrdus School Closed?

A Balanced Assessment

From an evidence-based perspective, the closure resulted from multiple interacting factors, with VAT acting as a tipping point rather than the sole cause.

Contributing factors included:

- Long-term demographic challenges affecting prep schools

- Increased staffing and pension costs

- Rising energy and maintenance expenses

- Sensitivity of parents to sudden fee increases

However, school leaders consistently stated that without the VAT hike, the school believed it could have continued operating or secured a viable future.

In that sense, VAT was not just a background condition—it was a catalyst.

Broader Impact: What the Carrdus School Closure Tells Us

Small Independent Schools Are Most at Risk

Larger private schools may be able to:

- Absorb VAT

- Spread costs across higher enrolment

- Use endowments or commercial income

Smaller prep schools like Carrdus lack these buffers.

Precedent for Future Closures

Since the VAT policy was announced, dozens of independent schools across the UK have reportedly closed or announced plans to close, often citing similar pressures.

The Carrdus School VAT hike closure is now frequently referenced as an early and emblematic case.

Political and Policy Debate

Supporters of the VAT policy argue that:

- Private education should not receive preferential tax treatment

- Additional tax revenue can support state education

Critics counter that:

- VAT disproportionately harms smaller, community-based schools

- Closures reduce parental choice

- Local state schools may face capacity pressures

Carrdus School sits at the center of this debate, used by both sides as evidence.

Frequently Asked Questions (FAQ)

When did Carrdus School close?

Carrdus School officially closed in July 2025, at the end of the academic year.

Did VAT directly cause the closure?

VAT was cited by the school as a major contributing factor, accelerating financial pressures and parent withdrawals.

Who owned Carrdus School?

Carrdus School was owned by the Tudor Hall School charity from 2011 until its closure.

Is the closure under investigation?

The Charity Commission opened a compliance case following complaints, but has not publicly alleged wrongdoing.

Will more schools close due to VAT?

Education analysts warn that smaller independent schools remain particularly vulnerable under the new tax regime.

Conclusion: The Significance of the Carrdus School VAT Hike Closure

The Carrdus School VAT hike closure represents more than the loss of a single prep school. It illustrates how national tax policy decisions can have immediate, irreversible consequences for small educational institutions operating on tight margins.

You May Like: OCR A Level Grade Boundaries 2017: The Definitive Guide to the First Reformed Exams